Nvidia Announces Another Record Quarter as AI Investments Remain Strong

U.S. tech giant Nvidia has reported results for its latest financial quarter, once again posting record-breaking numbers despite market pessimism:

- Revenue surged 56% to $46.74 billion over three months.

- Profit rose by more than 59% to $26.42 billion.

- For the current quarter, the company forecasts another 54% year-over-year increase in revenue, reaching $54 billion. Nvidia also noted that sales to China, where it is now officially allowed to export chips, could add an extra $2-$5 billion per quarter, while the entire market is valued at around $50 billion annually.

Paradoxically, Nvidia’s stock price dropped following the earnings announcement, even though the company’s profitability exceeds that of Apple or Meta, according to The New York Times. The reason is uncertainty about the future.

Nvidia’s record profits are driven by massive investments from tech giants in data centers and infrastructure for AI. However, investors are unsure whether such spending will remain sustainable long term, fearing that Nvidia’s revenues could decline in the future — along with its stock value.

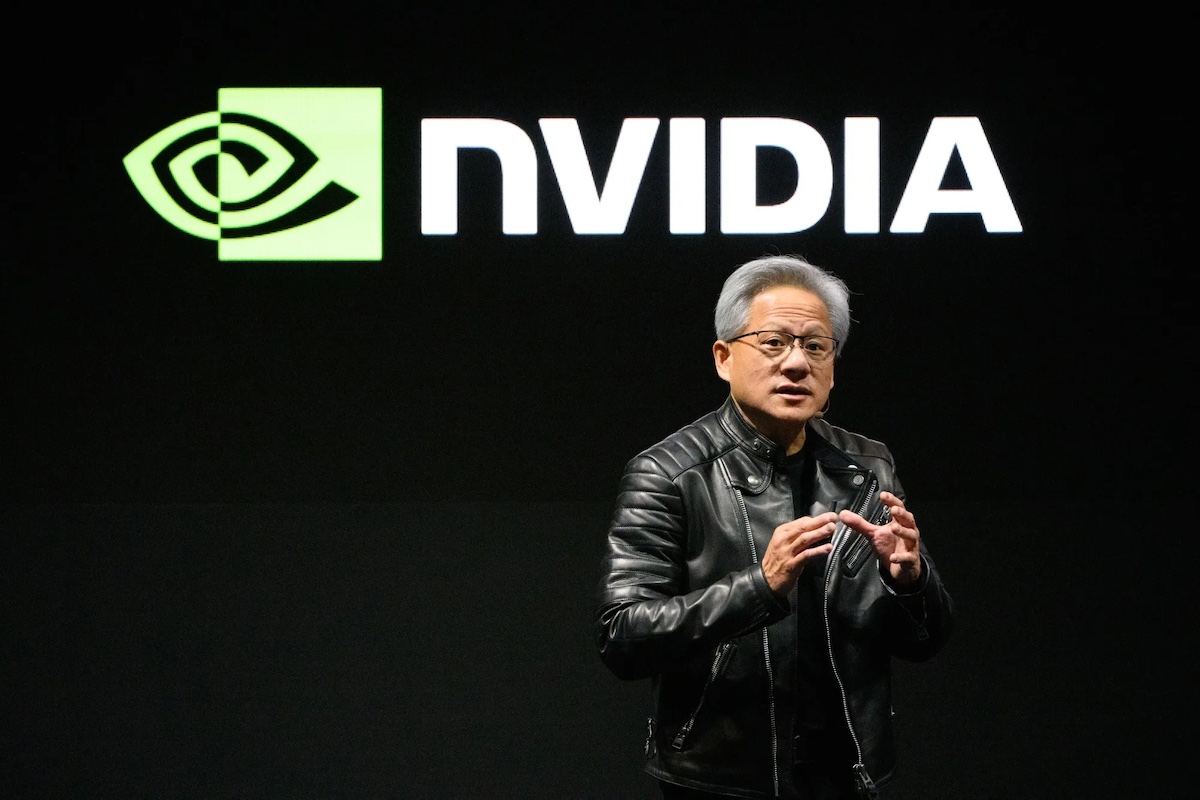

Still, CEO Jensen Huang takes a different view. He predicts that by the end of the decade, spending on AI infrastructure will grow to $4 trillion. The head of the world’s most valuable company is confident that today’s AI boom is just the beginning of a much larger story.

Another reason for market caution is Nvidia’s outsized influence on global markets. The company now accounts for 7.5% of every dollar in the S&P 500 index, up from 3% in December. Its results also affect the valuation of companies in the tech and energy sectors tied to the AI industry. A downturn in Nvidia’s business could drag down the broader market, which has been steadily climbing in recent months.

Don’t want to miss anything?

Subscribe to keep your fingers on the tech pulse. Get weekly updates on the newest stories, case studies and tips right in your mailbox.