Fintech Platform for Online Lending in Saudi Arabia

About the Project: Digital Transformation of Access to Loans

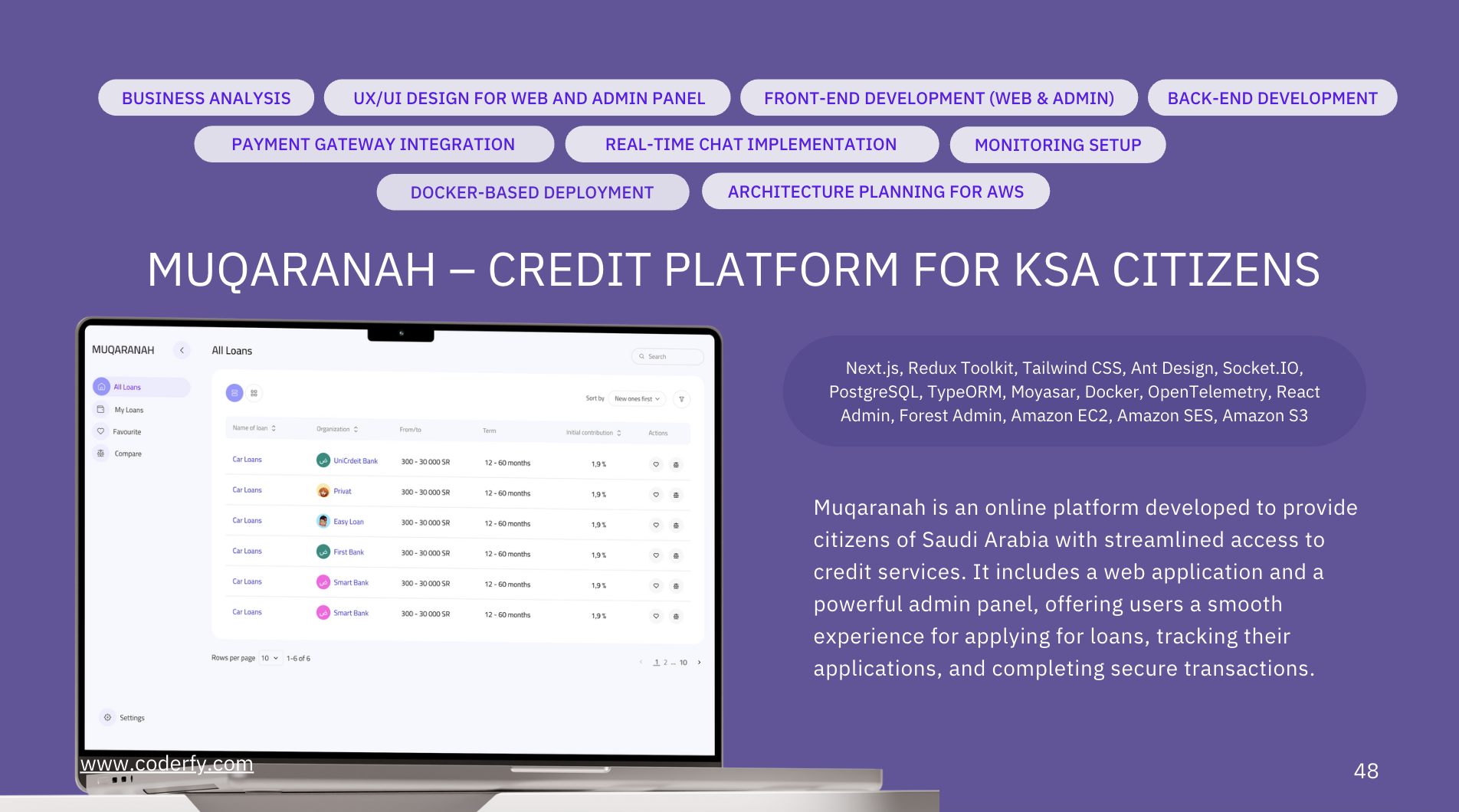

This project is a comprehensive online platform created to simplify and automate the process of obtaining loans for residents of Saudi Arabia. The solution includes a modern web application for clients and a powerful administrative panel for managing all operations, ensuring a transparent and convenient experience at every stage.

The Client and Their Challenges

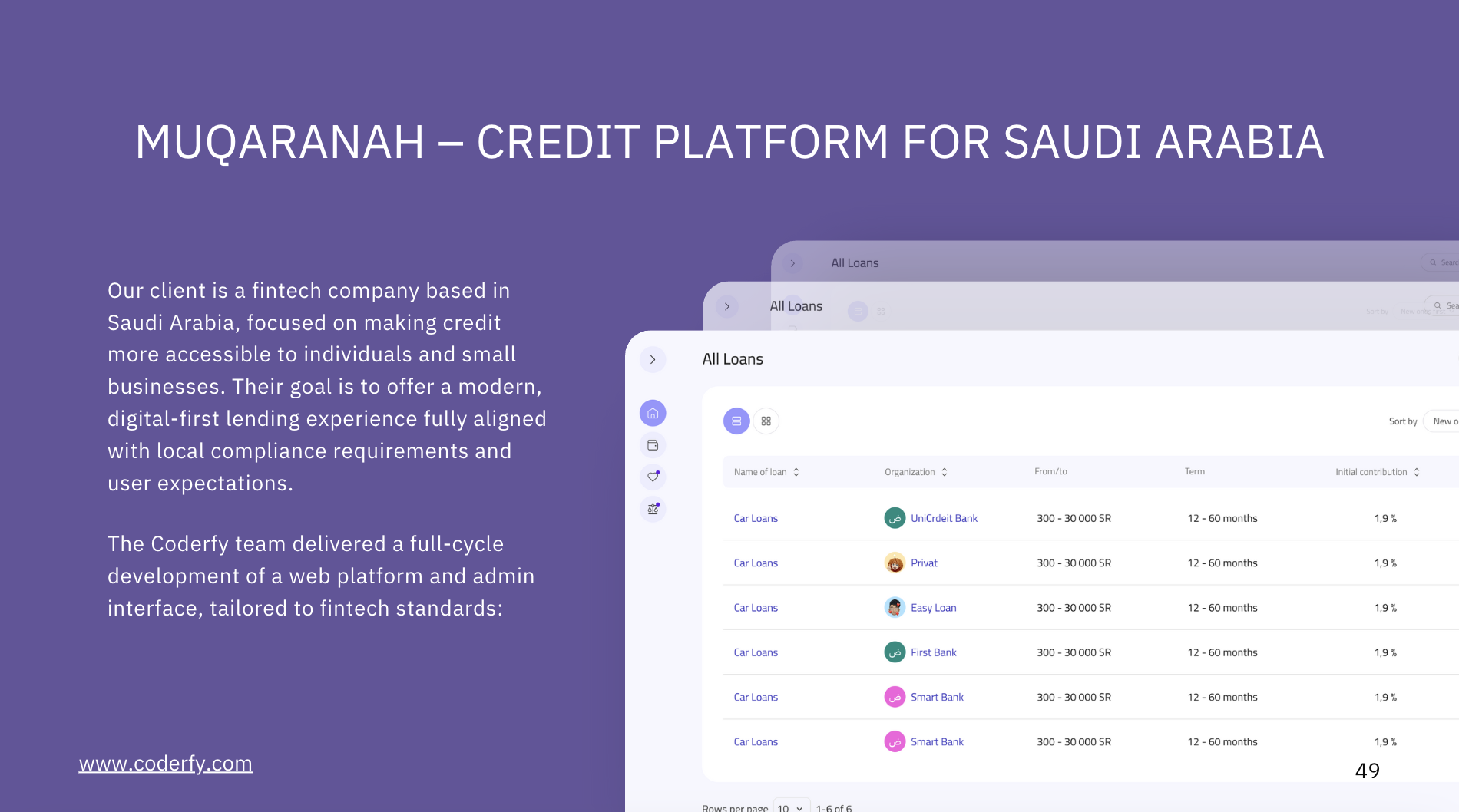

Our client is an ambitious fintech startup from Saudi Arabia that aimed to launch a leading digital lending platform.

They faced the following key challenges:

- Accessibility: To make credit services available to individuals and small businesses through a user-friendly online interface.

- Compliance: To ensure full compliance with the financial and regulatory requirements of Saudi Arabia.

- Trust: To create a reliable and secure product that would inspire user confidence in a region with high data security standards.

- Modern Experience: To meet user expectations for speed, real-time features, and intuitiveness.

Our Comprehensive Solution

The Coderfy team executed a full development cycle, creating a complex fintech product that includes:

- Client Web Application: Developed on Next.js for maximum performance and fast page loading. Redux Toolkit ensures efficient state management, while Tailwind CSS and Ant Design create a modern, responsive, and intuitive design.

- Real-time Features: Thanks to the integration of Socket.IO, users can instantly track their application status and communicate with support through a built-in chat.

- Powerful Admin Panel: Implemented using React Admin and Forest Admin, it allows administrators to effectively manage user data, applications, communications, and all platform workflows.

- Secure Payments: Integration with the Moyasar payment gateway guarantees secure transaction processing in accordance with local Saudi Arabian standards.

- Reliable Architecture and Monitoring: PostgreSQL and TypeORM formed the basis for data management, while Docker provided a stable and unified deployment environment. A monitoring system based on OpenTelemetry allows for tracking backend performance and stability.

Key Advantages for the FinTech Niche

The platform we created provides not just technology, but also strategic advantages for a business entering the financial services market:

- Full Market Compliance: Integration with local payment systems (Moyasar) and an architecture designed with regulatory requirements in mind allow the client to operate confidently within the legal framework of Saudi Arabia.

- High Level of Trust and Security: The use of proven technologies, reliable database tools, and secure payment gateways is the foundation for building user trust in a new financial product.

- Improved Customer Experience: Real-time features and a fast, intuitive interface set the platform apart from traditional banking products and increase customer loyalty.

- Operational Efficiency: A centralized admin panel automates routine processes, allowing the startup’s team to efficiently manage a large flow of applications and inquiries without expanding staff.

Result

We created a fully operational, secure, and scalable platform for online lending. The project successfully achieved all its goals: users can easily submit applications, track their status in real-time, and conduct secure payments. The powerful backend and user-friendly admin panel ensure the stable and efficient operation of the entire system.

Your Fintech Idea — Our Expertise

Creating complex financial products requires not only technical skills but also a deep understanding of market requirements, security, and regulatory norms. The Coderfy team has experience in developing reliable fintech solutions that win user trust and deliver results.

Ready to turn your idea into a successful fintech product?

Discuss Your Project With Us or Get a Free Consultation

Discuss Your Project With Us or Get a Free Consultation

Technical Project Details

Services Provided:

- Business Analysis

- UX/UI Design

- Front-end and Back-end Development

- Payment Gateway Integration

- Real-time Chat Implementation

- Monitoring Setup

- Docker-based Deployment

- Architecture Planning for AWS

Technology Stack:

- Front-end (Web Application): Next.js, Redux Toolkit, Tailwind CSS, Ant Design, Socket.IO.

- Back-end: PostgreSQL, TypeORM, Moyasar, Docker, OpenTelemetry.

- Admin Panel: React Admin, Forest Admin.

- Planned Integrations: Amazon EC2, Amazon SES, Amazon S3.

Don’t want to miss anything?

Subscribe to keep your fingers on the tech pulse. Get weekly updates on the newest stories, case studies and tips right in your mailbox.