Apple’s 10 Biggest Challenges — From AI to Tariffs

Recently, Apple has been criticized for its slow adoption of artificial intelligence technologies. While it once seemed like a long-term industry leader, the company now appears to be trailing other tech giants.

As Bloomberg reports, AI is just one of many challenges facing Apple today. With Trump potentially returning to office, the list is only growing. The company’s keynotes have become so predictable that no one expects any real revolutions anymore — the famous “One More Thing” has long been missing.

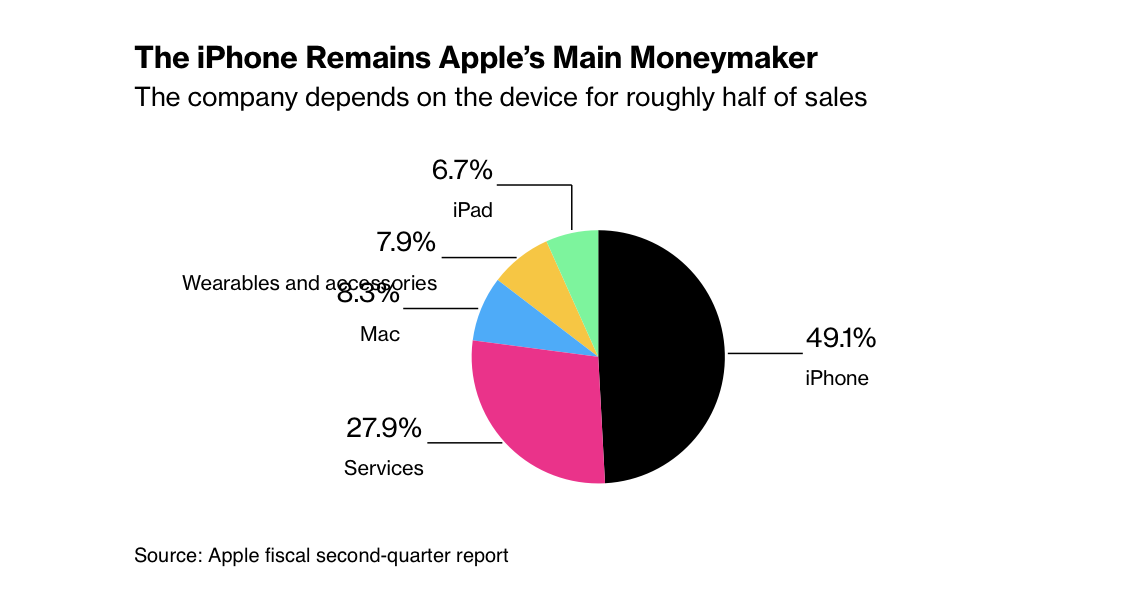

Although Apple still generates nearly $400 billion in annual revenue, the future seems less certain than it did just a few years ago. Here are the 10 most significant challenges the company faces:

1. Artificial Intelligence

After the release of ChatGPT in 2022, tech companies rushed to integrate generative AI. Apple, however, stayed on the sidelines for too long, raising concerns about falling behind in this crucial area.

In 2024, the company introduced Apple Intelligence, branding it as “AI for everyone.” But the launch was plagued by bugs, delays, and a lack of breakthrough features. A partnership with OpenAI offers some hope, but the long-promised overhaul of Siri is still not here.

At WWDC 2025, Apple barely mentioned Siri or AI, instead focusing on system design — and even that was met with ridicule and memes rather than excitement.

2. The Search for the Next Breakthrough

In 2024, Apple officially shut down its Apple Car project — saving billions but losing a potentially massive growth opportunity. The car, expected to cost around $100,000, could have sparked a wave of new revenue.

Now, the company is exploring smart home devices and AR glasses to compete with Meta, but no concrete plans have been announced.

3. Slow Start for Vision Pro

In 2023, Apple entered the VR market with Vision Pro — an engineering marvel with no clear use case. High pricing, bulky hardware, an external battery, and poor performance in low light make it feel more like a prototype than a mainstream product.

Apple says it’s working on a lighter, more affordable version, aiming for broader adoption as sales of the current model remain sluggish.

4. Google Search Deal at Risk

Apple reportedly earns $20 billion per year from Google to make it the default search engine in Safari. But a U.S. antitrust case could end this lucrative arrangement.

Apple is rumored to be exploring a potential acquisition of Perplexity AI to build its own search engine, but discussions are still in the early stages.

5. App Store Trouble and Developer Relations

A U.S. court ruling forced Apple to allow developers to redirect users to external payment sites. This could eat into App Store revenue from subscriptions and in-app purchases.

Apple may be forced to lower its commission fees to remain competitive, and it will also need to rebuild trust among developers.

6. Global Regulatory Pressure

In March 2024, the U.S. Department of Justice filed an antitrust suit against Apple, accusing it of suppressing competition.

In the EU, the Digital Markets Act requires Apple to open iPhones to third-party apps, browsers, and payment systems. While Apple agreed to lower fees, it introduced new charges — sparking backlash from developers.

7. Tariffs and Shifting Production Geography

After President Donald Trump threatened tariffs of up to 145% on Chinese goods, Apple began shifting production to India. However, Trump insists on iPhone production in the U.S., a move Apple views as economically unfeasible.

This could lead to higher iPhone prices this fall, making already expensive models even less competitive.

8. Succession Planning

Tim Cook has led Apple since 2011 and turns 65 this year. Many of his top executives are also nearing retirement age. While a smooth transition is expected, replacing Cook won’t be easy — he built Apple into a $3 trillion powerhouse, launched new product categories, and dramatically grew services revenue.

9. Declining Sales in China

In Q2 2025, Apple’s sales in China fell by more than 2% as local brands gained strength and government agencies began restricting the use of foreign tech.

For years, China was Apple’s major growth engine, with many new stores and rising revenues. Now, the tides are shifting.

10. Long-Term Smartphone Market Decline

Apple heavily promoted the AI features in iPhone 16, but it didn’t spark the expected boost. Smartphone sales fell 1% in the critical winter quarter.

In February, Apple released the budget iPhone 16e at $599, but the price makes it less competitive. Its predecessor, the iPhone SE, started at just $429.

Don’t want to miss anything?

Subscribe to keep your fingers on the tech pulse. Get weekly updates on the newest stories, case studies and tips right in your mailbox.